Business checking, the heart of commercial relationships for more than 200 years, just got a significant upgrade

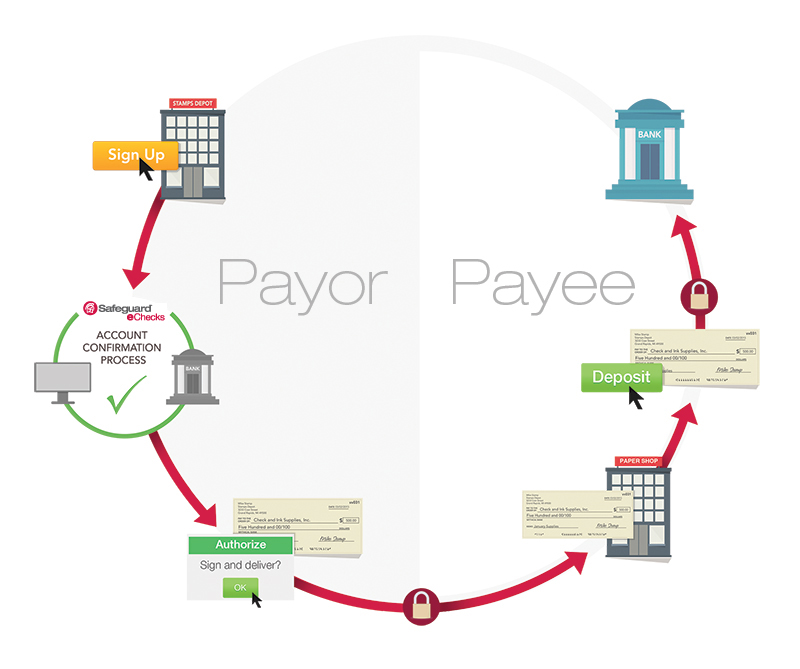

Safeguard eChecks lets business customers make and receive check

payments securely and entirely online, using a virtual lockbox and virtual remote deposit capture

system. Safeguard eChecks also helps prevent check fraud, improves processing efficiency and

drives deposit acquisition.

Distinguish yourself. Safeguard eChecks is an innovative solution for enhancing

your suite of treasury management products.

A new way to reduce risk and prevent fraud. Built on a fraud prevention platform, Safeguard eChecks service delivers the industry's first practical, usable universal Positive Pay system. Your institution can deliver a value-added service to commercial account holders, cutting costs for them

while reducing risk and helping prevent check fraud for them and you.

Business customers love the ease of Safeguard eChecks. Issuing one check, or thousands, is as easy as uploading a .CSV file into the Safeguard eChecks system. Plus, check recipients who are Safeguard eChecks users can print the check or deposit the funds via an RDC (Remote Deposit Capture) image capture process (conversion to a X9.37 check image).

A great way to introduce your commercial account holders to the value of RDC. Safeguard

eChecks' RDC works within existing infrastructure and standard check clearing procedures, along with your institution's Know Your Customer (KYC) protocols. You can activate account holders in minutes, and Safeguard eChecks requires no new equipment, no software installation and no maintenance or service calls.

Unlike other electronic payment options, Safeguard eChecks keeps your financial institution

squarely in the middle of the customer relationship, letting you competitively position yourself against third-party acquirers.

©2026 Safeguard Business Systems, Inc. Safeguard and the centurion head design are registered trademarks of Safeguard Business Systems, Inc. All other marks are the intellectual property of their respective owners.